It’s no secret that many startups fail. But what is less understood is that successful startups are often forced to make dramatic changes to their original plan in order to make it work.

Fortunately, startups tend to unfold in a predictable pattern. The more aware you are of this pattern, the better you’ll be able to capitalize on it. And, instead of feeling lost when you suffer inevitable setbacks, you’ll be able to put these problems in context.

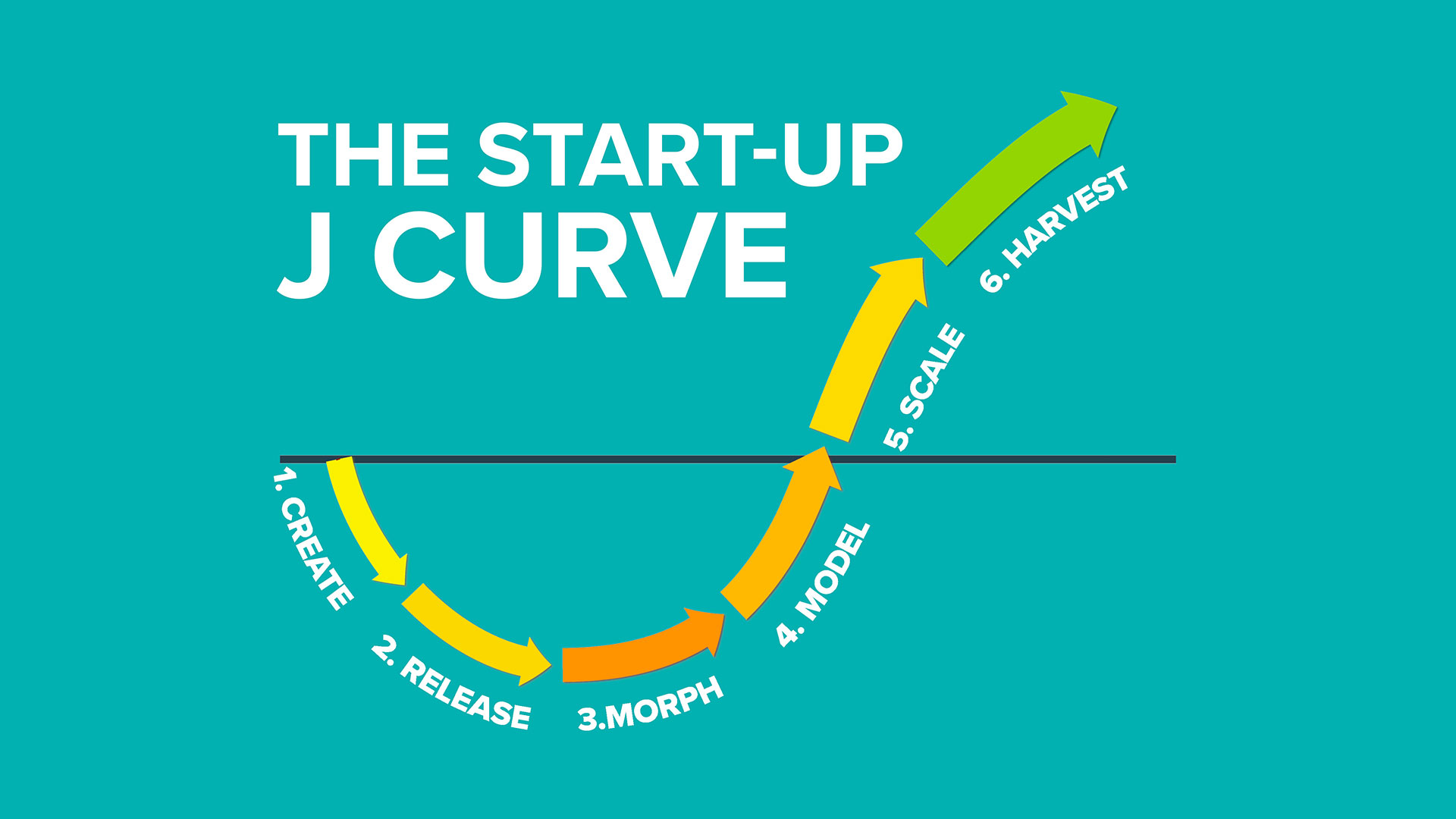

In this book summary of The Start-Up J Curve, we’ll explore the six predictable phases of the startup journey, including Create, Release, Morph, Model, Scale, and Harvest. Each one requires a primary focus and poses specific challenges. Knowing these phases and how to traverse them in the right way is critical for startup success.

Prepare For The Dip In The J Curve

As a founder, you always have more tasks to accomplish than time or resources to do them. The scarcity of resources is often extreme given the enormity of the mission, so efficiency becomes a critical discipline. With a map in hand, this allocation is much easier to do than when you’re flying by the seat of your pants.

The shape of the J curve is what differentiates it from other startup models. The base of the J represents a dip that occurs after the company is launched.

At first, the business idea captures everyone’s imagination, and it garners money, team members, and other forms of support. Then, reality sets in, products take longer to develop than expected, customers don’t embrace the initial offering, the business model doesn’t quite work, and eventually, money starts to dry up.

That dip is where startups either figure things out or die trying. This book provides strategies to help you get through this challenging period, so you can get to the steep upward slope of the J Curve, where the bulk of the value creation happens.

1. CREATE: Temper Dreams With Ideas, Teams, And Money

The Create phase is when everything seems possible. Unbridled optimism is typical, but don’t let that interfere with startup realities. In this phase, the three key elements to focus on are the idea, the team, and the money.

The Idea

Many inexperienced entrepreneurs believe that the idea is everything. But the idea itself may be responsible for only 5% of a startup’s success. That’s because (1) the vast majority of initial ideas don’t work out as first envisioned, and (2) no startup succeeds without a massive amount of nuts-and-bolts, grind-it-out execution.

The proper way to view an initial idea is as a hypothesis. It may or may not work. If it doesn’t work, you’ll take what you’ve learned and create something new that is more likely to succeed. So avoid pursuing the original idea as if it’s the Holy Grail.

There are three viable options for identifying building block ideas or products, including a product or service that solves a problem, a visionary ‘breakthrough’ product, or an opportunistic product. Each option is covered in more detail in the book.

The Team

Start by considering whether you will go it alone as a founder or bring in one or more co-founders. Generally speaking, co-founders have advantages in that they can provide complementary skills, knowledge, and expertise. There will be tough times, and it’s good to have a partner to help resolve significant challenges.

Rugged individualism is a philosophy many entrepreneurs embrace, yet it can be counterproductive to startup success. Putting together the strongest possible team with complementary skills and character traits is critical to startup success.

The Money

Contrary to what entrepreneurs may believe, this early stage is one of the best times to raise money from various sources. That’s because it can often be easier to raise funds while the early excitement runs high and difficulties have yet to be identified.

Unfortunately, many entrepreneurs raise too little upfront on the assumption that it will be easier to raise money later. They often underestimate two things: how quickly they will burn through initial investments and how long it will take them to reach future milestones that are significant enough to justify a meaningfully higher valuation.

While dilution reduces your share of the company, the additional funds increase your odds of making it successful. The result is that your remaining shares should go up in value. So focus on what your holdings are worth, not the percentage of the company.

2. RELEASE: Get The Damn Thing Out There

Once the team, idea, and money are in place, it’s time to get the initial product or service out into the market. This step is critical to test your hypothesis and gather feedback. However, some entrepreneurs suffer from procrastination at this stage due to both practical and psychological blocks.

Here are some examples of practical blocks:

- Not embracing the minimum viable product (MVP) model.

- Failing to maintain a tight product spec to simplify the release.

- Underestimating the time, energy, and resources that are needed.

- Allowing feature creep to unnecessarily drag the process out.

- Falling into the trap of perfectionism.

Here are some examples of psychological blocks:

- Fear of being judged once the product hits the market.

- Fear of failure and how that will reflect on you or the startup.

- Having a tinkering mindset instead of urgency to release.

In order to overcome these blocks, it’s essential to embrace a release process that addresses the six following tips:

- Aim for a minimum viable product (MVP) to validate your idea.

- Release it into the market (skip the big launch to conserve money).

- Focus on initial customer acquisition to gather early feedback.

- Facilitate feedback to gather as much useful data as possible.

- Listen and pay close attention to what customers care about most.

- Keep expenses low, so you can iterate your product moving forward.

IMPORTANT: This is NOT the make or break phase that many startup founders believe it to be. The odds are that customers will not greet your product with fanfare. In all likelihood, their reactions will be mixed at best. Be flexible and open-minded when the feedback starts coming in, and don’t be discouraged by criticism.

You may have felt that you had an epiphany with your original product idea, but this is where the real epiphany happens. That’s because you now have information that you would not have uncovered without releasing the first iteration of the product.

3. MORPH: Embrace Radical Change

Remember, the goal of your initial product is to prove your hypothesis. If you validate it by gaining meaningful customer traction, you will want to iterate further, making incremental improvements based on customer feedback.

However, most startups need to make substantial, often drastic changes to their original plan to achieve customer traction. So prepare yourself for the Morph phase, which is full of stops and starts. Take all the feedback you acquired in the release phase and use it to re-create your product.

A morph implies a fundamental change in product, market, or strategy—or all three. It’s not about making iterative, incremental changes. In order to morph effectively, significant changes are required, and they are often gut-wrenching. Many startups have to make multiple morphs because the first one or two may not work.

To get to a great product quickly, ask yourself the following questions:

- What is working for your product?

- What are customers talking or writing about?

- What about your product attracts customers?

- What do customers want to see more of?

- What aspect of the product appears to address a real need?

Do more of what’s right for your product and less of everything else. Brainstorm with your people. Seek to make drastic changes based on customer feedback. Then create a new hypothesis and move forward with a new release to test it.

The litmus test of a successful morph is customer traction: customers are engaging with and loving the product, despite the obvious flaws that are always evident in any MVP. Once you have this type of customer traction, you can stop morphing and go back to making smaller, iterative improvements.

4. MODEL: Nail It Before You Scale It

Having morphed your product to a stage where you’ve established a strong and growing customer base, your next job is to nail the business model, determining how you make profits. The goal is to reach the point where more cash will be generated on the back end if you put more investment money into the business.

It’s essential to recognize that your original idea of how the business will make money may no longer fit after iterations or morphs. So, look at the startup as it exists today and ask yourself: what is the best way to monetize this?

Strong models usually have some, or all, of the following characteristics:

- High Margins – Either on a percentage basis or an absolute dollar amount.

- Low Friction – It’s easy for customers to buy and engage with the product.

- Network Effect – The product is more valuable as more customers use it.

- Repeatable – Initial success can be replicated as you reach new customers.

- Scalable – You can invest money and grow without hurting the model.

The process of getting to the optimal business model is the same as getting to the right product. You start with a hypothesis, test it, listen to the feedback, study the data, and then either iterate with incremental improvements or morph to a new hypothesis.

You need to get to the point where it’s evident that the company will generate positive cash flow at a certain point. You may decide to invest all of that positive cash flow into growth, and that’s okay. But you should be honestly convinced the business model can and will generate cash.

5. SCALE: Go Big With People, Process, And Money

The Scale phase is where much of the substantial value is created for investors. However, this can be a tricky stage for some entrepreneurs, in that they need to leave behind their small and insular mentality and build out the company.

Now is the time to assemble the people, processes, and money necessary to take the company to the next level. So let’s examine these three categories.

People

As the business grows, you can no longer rely on freewheeling generalists. It’s time to find specialists who are experts in various functional areas. Employees who have been tremendously valuable up to this point may become liabilities if they can’t adjust to the needs of a rapidly growing company.

You and your inner circle need to decide on your areas of expertise and then focus exclusively on them. People are going to complain that you’re destroying what made the company great. In reality, you’re trying to survive and thrive in a different form, and that means redefining everyone’s roles.

It’s also essential to hire people who can do more than their current role requires. That way, they will be able to take on additional responsibilities as the business scales up.

Processes

There will be all sorts of processes that need to be put in place as you grow. This step is critical because the business will need systems to facilitate scaling at a healthy rate without driving everyone crazy.

You know it’s time to implement a process when you experience repeated fire drills around the same issue. Fire drills are time-consuming, expensive, and frustrating for all involved. Procedures protect the brand, the revenue, and the people from such issues.

Money

It’s tough to scale on the cheap. Don’t be naive about how much capital is required to expand your operation. You can’t attract talent without offering salaries commensurate with that talent, and you can’t scale effectively if you don’t have that talent in place.

Ideally, you’ll generate cash flow based on your sales. If you’ve gained customer traction and people love your product, the odds are that your revenues will increase significantly. And these funds can be used to scale the organization.

Another option is venture capital. VCs love to invest money in companies with a terrific product, strong customer traction, an established business model, and a desire to get big. They also tend to be great at scaling and can contribute in many other ways.

Get The Word Out

Sales and marketing are usually the key engines to growth in the Scale phase. Now isn’t the time to be secretive or coy; it is the time to sell the hell out of your product.

Use whatever marketing tactics have worked to get you where you are, and ramp up whichever ones can scale. Don’t limit yourself to any single approach. Be aggressive about testing a variety of new channels and track the effectiveness of everything.

This is the phase where your product and company can make their mark on the world.

6. HARVEST: The Joy of Puffball Decisions

The Harvest phase is, in most respects, the easiest and the most enjoyable. It’s primarily about capitalizing on the opportunities you have created by building a strong business. It’s time to reap what you’ve sown in the previous five phases.

This is a good thing, but it’s also a complex one. At this point, the start-up is reaching maturity, and a lot of challenging decisions must be made: should you expand through acquisition or organically, should you take a large buyout offer; should you provide liquidity to investors through a buyback, IPO, or company sale?

Future Growth

Most companies have a natural growth rate that matches the product with the opportunity and the company’s ability to capture that opportunity. Many entrepreneurs in the Harvest phase are overly infatuated with continued hypergrowth of 100 to 200 percent per year that is more appropriate in the Scale phase.

One of the primary dangers in the Harvest phase is that you start saying yes to too many things, especially good but not great opportunities. So focus on finding the right rate for growth. Too fast and you are not spending efficiently, too slow and you are ceding opportunity to the competition.

Paying Investors

Start-up founders are responsible for compensating shareholders, including investors and employees with a stake in the business. Options include: launching an initial public offering (IPO), selling the company, using share buybacks, or paying dividends.

- An initial public offering (IPO) achieves two goals simultaneously: providing liquidity to shareholders and more cash for growth.

- If you sell the company, you have a clean way to exit and provide liquidity (this is the ideal phase for being acquired).

- If you have adequate cash flow, share buybacks help you keep ownership simple and corporate overhead low.

- Or you can pay dividends as a way to share the profits with shareholders while allowing them to also participate in the long-term value creation.

Excess Cash

Unlike the previous Scale phase—where your expenses equaled or surpassed your revenue—you now have the luxury of revenues exceeding your costs. Excess cash provides you with the opportunity to pursue several growth strategies, including new products, brand investments, global expansion, or acquisitions.

- New products are usually the core growth driver. You now have the infrastructure to streamline the development, marketing, and distribution of new products.

- Brand investments help attract new customers and provide some protection against economic swings, competitors’ new products, and more.

- The Harvest phase is the perfect time to expand internationally as you now have the cash and bandwidth to conquer a new mountain.

- Acquisitions can be tricky. Most fail to deliver on their promise. But, acquisitions where technology, products, or people are included tend to do better.

The Two Most Common Start-Up Journey Mistakes

By working phase-by-phase, entrepreneurs keep their workload manageable and can control related stress more effectively. However, doing things in the wrong order is one of the surest ways of sabotaging your startup.

Two of the most common mistakes are (1) focusing on the business model before figuring out the product and (2) scaling before nailing the product or business model.

Focus On Customer Traction Before The Business Model

When you explain your business idea to people, you’ll be peppered with questions such as, “How are you going to make money at that?” While you don’t want to ignore that question completely, the real questions to focus on are “Can I make something people will really want?” and “Can I get customers to use my product or service?”

History has generally proven that if you can get customer traction, you can find some way to make money. By focusing too much on the revenue model, you may be creating a myopic view of what your idea should be. And this can prevent you from exploring alternative paths that could deliver greater customer traction.

Nail The Product Or Business Model Before Scaling

It’s common for a company in the Release or Morph phase to make the mistake of implementing an ambitious growth plan. They often believe that they can simply scale up marketing to drive customer adoption. But, scaling a flawed business model simply increases the size of the problem.

Instead of bleeding a little money, you’ll be hemorrhaging significant cash, and eventually, you’ll slam into a wall. In many instances, this mistake is made because a startup has too much money early on. To avoid this mistake, follow the sequence of the phases to be sure you nail the business model before scaling.

Beyond The Start-Up J Curve Book Summary

This summary of The Start-Up J Curve is just a quick preview of the framework. It’s not a substitute for reading the book. That’s because the original text provides a much richer learning experience.

So if you’re an entrepreneur that is serious about startup success, pick up a copy of the book. The Start-Up J Curve is available from Amazon and Apple Books.

Are you looking for another great book? Consider checking out the best startup books, the best product management books, or the best digital marketing books.

You can also subscribe to The Rick Kettner YouTube Channel or The Rick Kettner Podcast to get updates about future book summaries and reading lists.